Avoid cash advance charges

How to avoid the high fees and charges for credit card cash advances

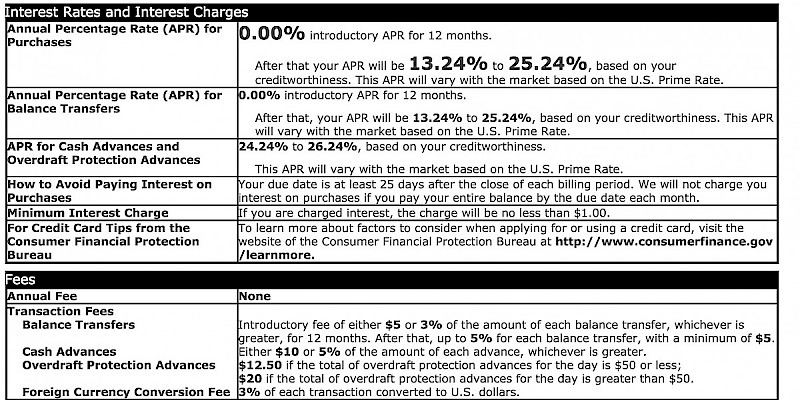

Some credit cards are now charging exorbitant "transaction fees"—plus a laughably inflated APR, which starts accruing immediately—for each cash advance through a credit card, so read the fine print carefully when choosing which Visa card to use on the road.

Use cash advances only in emergencies. These credit card folks are counting on your complacency to keep milking you for money. Don't give them the satisfaction.

Whenever you get a cash advance on a credit card, the bank starts charging you interest immediately , not after the end of the billing cycle's month as they do with purchases.

That means if you take out $200 on the first day of a two-week trip, for two weeks the credit card issuer will be charging you the highest possible interest rate (not that introductory 9.67%, but the industry ceiling of 18% or more), compounded daily, and will continue to do so until you pay your entire credit card bill all the way down.

They often also tack on a one-time "service fee" of $5 or more as well.

You may be able to avoid all this, however, by being a bit sneaky: They can only charge you interest if you're carrying a balance. The trick is to make sure you never carry a balance on the card by overpaying your bill (by however much you expect to withdraw in cash advances, plus purchases) the month before you leave.

It's silly, but it usually works.

- Findabetterbank.com - Site to find credit unions and other local banks. These often have low or no foreign transaction fees on their credit cards and ATM fee–refund policies.

- Capitalone.com - Offers cards with no foreign transaction fee, and chip-and-signature enabled (making it easier to use in Europe).

- Bankofamerica.com - Offers cards with no foreign transaction fee, and chip-and-signature enabled (making it easier to use in Europe).

- Madfientist.cardratings.com - Good simple search engine to find travel-worthy cards, from no foreign fees to the ones with the best points.

- Ally.com - Online-only bank (and the one I use), with ATM feee refunds and no foreign transaction fees. Sadly, no credit cards (yet)—though you can use your MasterCard-branded bank card as a debit card.

- Usaa.com - Online-only bank open to current and former U.S. military personnel and their families; ATM fee refunds, and credit cards with only 1% foreign transaction fees.

- Schwab.com - This famous brokerage firm also offers online-only checking and savings accounts with ATM fee refunds.

- Asmarterchoice.org - Credit union–finding site. Credit unions often have low or no foreign trasnaction fees on their credit cards, ATM fee–refund policies, very few fees, and interest-bearing checking accounts. In other words: What a bank should be.

- Findabetterbank.com - Site to find credit unions and other local banks. These often have low or no foreign transaction fees on their credit cards and ATM fee–refund policies.

- Ncua.gov - All about credit unions.

- Credituniondb.com - Bare-bones credit union-finding database.