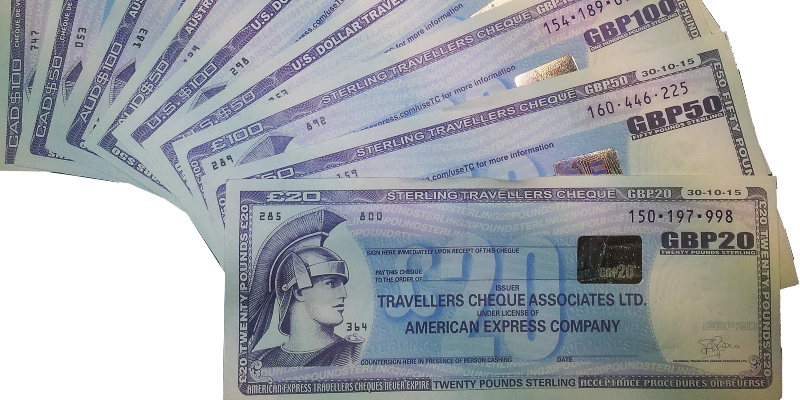

Traveler's cheques

Why traveler's checks can sometimes still matter (as a way to carry emergency backup cash) in the age of ATMs and computerized banking

Back in the Dark Ages of Tourism (circa 1850-1995), a traveler's check—or, if you're British, traveller's cheque—and the local American Express or Thomas Cooke office were the only way to get your paws on some local cash while abroad.

However, the aggressive evolution of computerized banking and proliferation of faster, easier, and cheaper-to-use ATM machines have over the past decade turned these old travel standbys nearly into quaint museum pieces.

What is a traveler's check?

For those of you new to foreign travel: a traveler's check is a form of Monopoly money that the whole world has agreed to treat as if it were real. It's a pre-paid slip of paper worth $20, $50, or $100 (there are bigger denominations, plus tensies, but none are useful for European travel).

You buy these things for face value from your bank, AMEX travel office, or AAA office—though your bank may charge you a modest fee, and only AAA members and AMEX cardholders can buy the things from those respective businesses without paying the usual 1% to 4% commission.

There's a space on the check where you sign each and every one before you take off on your trip (there are "couples" version that you both sign so that then either can use them).

The downside to traveler's checks

Making a special trip to the bank or AAA office and signing a pile of papers is but the start of the pain-in-the-butt process of using traveler's checks. Cashing traveler's checks—exchanging them for British pounds or other local currency—can be a tedious process.

Once you’re in the U.K., you have to find a bank (and "banker's hours" over there are even more restrictive than back home), American Express office (of which few remain; London has one at Heathrow Airport and another at 30-31 Haymarket, just down from Piccadilly Circus), or (in a pinch) exchange booth—many larger shops and hotel front desks will do this, too, but at awful rates—wait in line, dig your passport out of your money belt, wait for them to go photocopy it, countersign and date all the checks you’re going to cash (these days often limited to $200 a visit), and then carefully jot down each check's serial number.

In return, the bank will give you some pounds at a lousy rate while charging a high commission.

Excited yet? There is a point to all this: insurance.

The benefits of travelers' checks

Traveler's checks still have one huge advantage over any other form of carrying money:

If lost or stolen, traveler's checks will be replaced by the issuer, free of charge.

Remember the step back before you left home where you wrote down the checks' serial numbers on your backup info sheet? (You did.)

That's crucial, because when you get back to your hotel at the end of the day you have to cross those numbers off the master list of all your checks' serial numbers—the one you laboriously copied down on a separate sheet of paper and have been carting around Europe with you while making sure to keep it in an entirely different place from the checks themselves (see, if you loose the checks and the list, you're out of luck because you can't tell AMEX, or whomever, which ones to replace). » more

Traveler's checks also also computer-proof. Sometimes you'll find the ATMs of an entire town evilly disposed to your bank card or Visa (perhaps a computer glitch or the phone connections to check your PIN are down). A handful of traveler's checks in your money belt can save the day, and they remain the safest way to carry your dollars.